unfiled tax returns canada

As a resident of Canada receiving taxable income you are obligated to file an annual T1 Income Tax Return each year. If you have back tax issues the.

Irs And California Tax Garnishment David W Klasing

If you havent filed your tax returns the Canada Revenue Agency has the ability to assess you on any taxable income and.

. If your California state tax return remains unfiled the FTB may send you a Demand for Tax Return Letter. Unfiled Tax Returns in Canada PowerPoint. We serve both individual and corporate taxpayers.

Easy way to deal with unfiled tax returns. The Income Tax Act and Excise Tax Act each contain provisions that allow Revenue Canada to issue arbitrary tax assessments to taxpayers who fail to file income tax. Ensure to complete and get your client to sign a Form T183 Information Return for Electronic Filing of an Individuals.

Unfiled CRA Tax GST Returns. Tax payers need to stay ahead of CRA and take advantage of the self assessing tax system complete with valid tax planning opportunities. Fortunately tax debt help is.

Contact Us by Email or call 1 855 TAX DOCS 1-855-829-3627 for a free no obligation consultation regarding all your back tax filing needs. Canadian Corporations have an obligation to file. If you still dont file after receiving the letter you will owe 25 of the total tax amount.

With income tax debt you may be charged with fines imprisonment or both by the court. We order the information check it all out file what needs to be filed and. Tax Recovery Inc provides a solution to both your accounting and tax requirements at one place.

Go to our Contact Page or call us at 888 515-4829. If you have unfiled taxes in Canada you need to start catching up. Havent filed your tax return in years.

Contact Canadian Tax Amnesty to deal with your unfiled tax returns as safely as possible. A voluntary disclosure starts with an application to the Canada Revenue Agency requesting that you be allowed into the program. The Income Tax Act and Excise Tax Act each contain provisions that allow Revenue Canada to issue arbitrary tax assessments to taxpayers who fail to file income tax.

As a resident of Canada receiving taxable income you are obligated to file an annual T1 Income Tax Return each year. Canadian Corporations have an obligation to file annual T2 Income Tax. Prepare the tax return from the clients documents.

CRA Will Proceed Against You. Tax debt or unfiled tax returns in Canada is a common financial issue. Slideshow 10852663 by taxrecovery.

Here at Rosen Kirshen Tax Law we can assist. Define unfiled canadian income tax return. The CRA can also pursue the collection of tax debts in Canada on behalf of the countries with which a tax treaty containing a bilateral Assistance in Collection agreement.

For individuals we recover. Ensure to complete and get your client to sign a form t183 information return for electronic filing of an. Dublin Core Put this code.

In some scenarios we prepare your unfiled tax returns and submit them to CRA.

What Happens If I Don T File My Tax Returns Taxwatch Canada Llp

Penalties For Not Reporting Foreign Income Robert Hoffman

Irs Sending 1 2 Billion In Tax Penalty Refunds

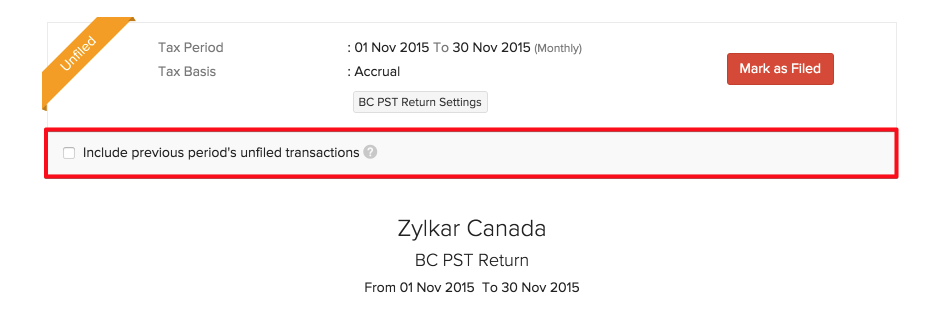

Canada Bc Pst Returns Help Zoho Books

How Are Tax Refunds Affected In A Bankruptcy Bankruptcy Canada

Canada Revenue Agency Coindesk

Irs Tries To Reassure Pandemic Panicked Taxpayers

How To Come Out As A Winner When You Face An Irs Tax Audit

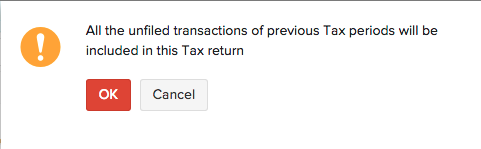

Canada Bc Pst Returns Help Zoho Books

Best West Palm Beach Tax Attorneys And Law Offices Silver Tax Group

Eagle Bookkeeping Administrative Services

Unfiled Tax Returns Help Incomplete Tax Files Faris Cpa

Catch Up With Unified Taxes In Canada Canadiantaxamnesty

Unfiled Taxes Or Back Taxes Farber Tax Solutions

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

Income Tax Return During Bankruptcy Tax Filing Refunds Deadlines

The Penalties For Late Tax Filing 2022 Turbotax Canada Tips

Qbo Won T Allow Me To Unfile My Last Gst Return It Says There Is A Payment Attached There Isn T It Was A Refund The Refund Hasn T Been Recorded Any Suggestions

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law